Presentation

Williams Peprah Poster.pdf

2024 MBAA International Conference

(2024)

Abstract

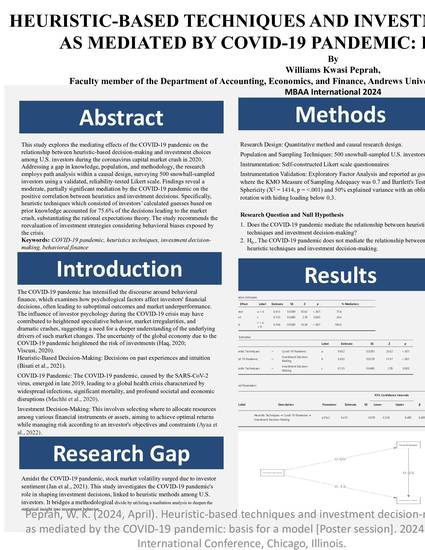

This study explores the mediating effects of the COVID-19 pandemic on the relationship between heuristic-based decision-making and investment choices among U.S. investors during the coronavirus capital market crash in 2020. Addressing a gap in knowledge, population, and methodology, the research employs path analysis within a causal design, surveying 500 snowball-sampled investors using a validated, reliability-tested Likert scale. Findings reveal a moderate, partially significant mediation by the COVID-19 pandemic on the positive correlation between heuristics and investment decisions. Specifically, heuristic techniques, which consisted of investors’ calculated guesses based on prior knowledge accounted for 75.6% of the decisions leading to the market crash, substantiating the rational expectations theory. The study recommends the reevaluation of investment strategies considering behavioral biases exposed by the crisis.

Keywords

- COVID-19 pandemic,

- heuristics techniques,

- investment decision-making,

- behavioral finance

Disciplines

Publication Date

Spring April 12, 2024

Location

Chicago, Illinois.

DOI

DOI: 10.13140/RG.2.2.33780.56969

Citation Information

Peprah, W. K. (2024, April). Heuristic-based techniques and investment decision-making as mediated by the COVID-19 pandemic: basis for a model [Poster session]. 2024 MBAA International Conference, Chicago, Illinois. DOI: 10.13140/RG.2.2.33780.56969.