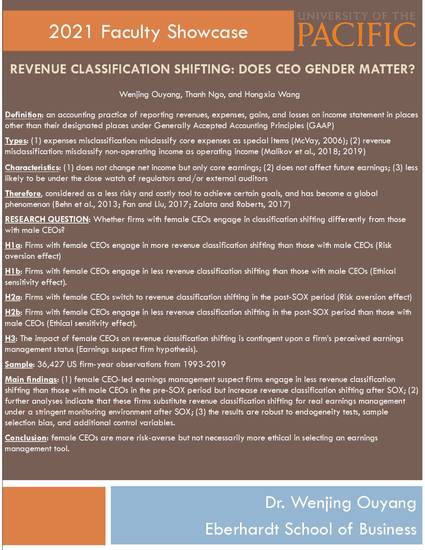

Instead of managing bottom-line earnings, firms may use revenue classification shifting to inflate core earnings due to its less risky, less costly, but viable features. Using a sample of 36,427 US firm-year observations from 1993-2019, we show that female CEO-led earnings management suspect firms, i.e., those that just beat important earnings threshold, engage in less revenue classification shifting than those with male CEOs in the pre-SOX period, but increase revenue classification shifting after SOX. Further analyses indicate that these firms substitute revenue classification shifting for real earnings management under a stricter monitoring environment after SOX. The results are robust to controlling for both accrual and real earnings management, endogeneity tests, sample selection bias, and additional control variables, providing new evidence that female CEOs are more risk-averse in selecting an earnings management tool.

Available at: http://works.bepress.com/wenjing-ouyang/26/