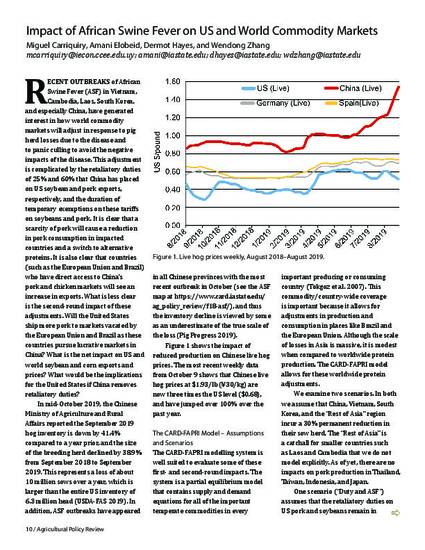

Recent outbreaks of African Swine Fever (ASF) in Vietnam, Cambodia, Laos, South Korea, and especially China, have generated interest in how world commodity markets will adjust in response to pig herd losses due to the disease and to panic culling to avoid the negative impacts of the disease. This adjustment is complicated by the retaliatory duties of 25% and 60% that China has placed on US soybean and pork exports, respectively, and the duration of temporary exemptions on these tariffs on soybeans and pork. It is clear that a scarcity of pork will cause a reduction in pork consumption in impacted countries and a switch to alternative proteins. It is also clear that countries (such as the European Union and Brazil) who have direct access to China’s pork and chicken markets will see an increase in exports. What is less clear is the second-round impact of these adjustments. Will the United States ship more pork to markets vacated by the European Union and Brazil as these countries pursue lucrative markets in China? What is the net impact on US and world soybean and corn exports and prices? What would be the implications for the United States if China removes retaliatory duties?

Available at: http://works.bepress.com/wendong_zhang/76/