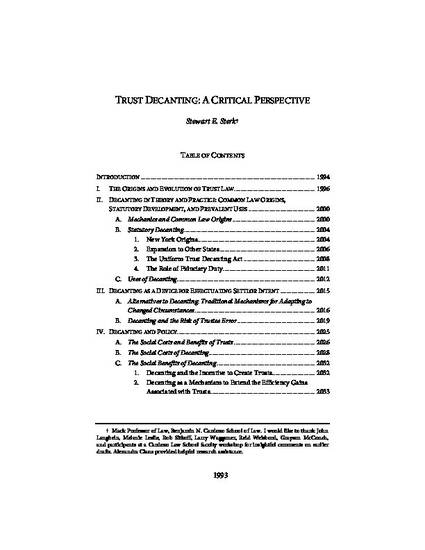

Until recently, a party seeking modification of an irrevocable trust needed approval from all interested parties, or from a court. The last decade, however, has brought a flood of state legislation authorizing trust decanting – a process by which a trustee “decants” trust assets from one vessel (the original irrevocable trust) into a second vessel (a new trust with terms designed to reflect the settlor’s supposed intent). Most recently, the Uniform Law Commissioners have, in 2015, promulgated the Uniform Trust Decanting Act.Decanting enable trustees and trust beneficiaries to avoid the cost associated with judicial modification in cases where the irrevocable trust instrument included drafting errors or failed to account for unforeseen circumstances. But the proponents of decanting have largely ignored two significant issues raised by the decanting movement. First, the trustee, who may have been selected for reasons other than intimate knowledge of the settlor’s wishes, is not always in an optimal position to assess that settlor’s intent. In some cases, agency costs (the trustee’s own interest in continuing to receive fees) may cloud the trustee’s judgment about the wisdom of decanting.Second, decanting increases the potential for trusts to impose external costs on taxpayers and creditors. A number of recent innovations in trust law have expanded asset protection opportunities and enabled creation of perpetual trusts – innovations that enable trust settlors to avoid taxes and creditor claims. Trusts created before these doctrinal changes could not take advantage of these opportunities to impose external costs. Decanting, however, empowers trustees to obtain tax benefits and avoid creditors even when the settlor was willing to create the trust without the inducements provided by modern doctrinal “reform.” Decanting to impose externalities generates social cost without any offsetting social benefit.

- trusts & estates,

- agency costs,

- reform

Available at: http://works.bepress.com/stewart_sterk/93/