Article

Impact of Economic Shocks on Financial Access: Evidence from Covid-19 Pandemic

New Zealand Financial Market Conference

(2021)

Abstract

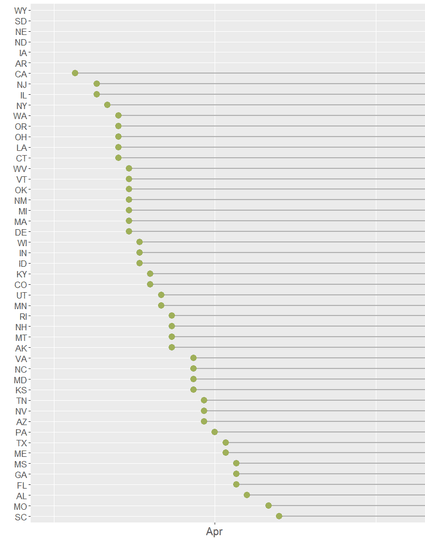

This paper examines the impact of an economic shock and the government response on financial access for underserved consumers. Using foot traffic to consumer lenders as a proxy for loan demand, we find that the shelter-in-place order, new Covid-19 cases, and the government relief program (PEUC) are associated with a drop in visits to consumer lenders after controlled for the online borrowing and the supply of credit. Using natural experiments of the statewide shelter-in-place order and FPUC program, we find that the lockdown suppresses financially underserved consumers’ access to credit, while the supplemental paychecks (FPUC) cushion their economic blow by further reducing visits to consumer lenders. We also find that regular unemployment insurance is less effective in reducing demand for consumer credit in financially underserved areas than in metropolitan areas. The demand for consumer credit is positively correlated with the average consumption level in an area. Lastly, we find differences in the impact of the government relief programs on visits to banks and visits to consumer lenders.

Disciplines

Publication Date

2021

Publisher Statement

Contributor, A. A., Contributor, B. B., Contributor, C. C., & Contributor, D. D. (Year, Month Day). Title of contribution [Description of contribution]. Title of Symposium/Conference, Location.

Citation Information

Goel, A., & W. S. (2021, September). Impact of economic shocks on financial access: Evidence from Covid-19 pandemic [Conference paper]. New Zealand Financial Market Conference, Online.