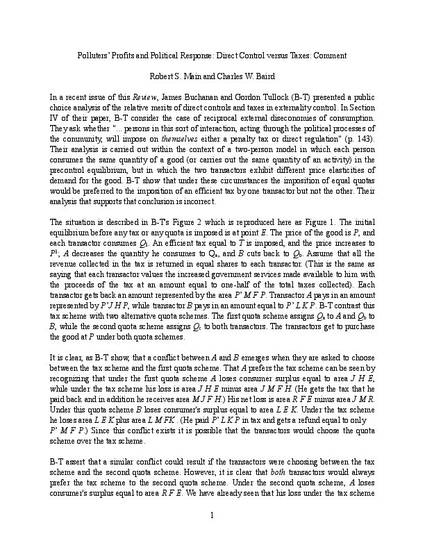

In a recent issue of this Review, James Buchanan and Gordon Tullock (B-T) presented a public choice analysis of the relative merits of direct controls and taxes in externality control. In Section IV of their paper, B-T consider the case of reciprocal external diseconomies of consumption. They ask whether "... persons in this sort of interaction, acting through the political processes of the community, will impose on themselves either a penalty tax or direct regulation" (p. 143). Their analysis is carried out within the context of a two-person model in which each person consumes the same quantity of a good (or carries out the same quantity of an activity) in the precontrol equilibrium, but in which the two transactors exhibit different price elasticities of demand for the good. B-T show that under these circumstances the imposition of equal quotas would be preferred to the imposition of an efficient tax by one transactor but not the other. Their analysis that supports that conclusion is incorrect.

This is a post-print version of this article. The version of record is available at JSTOR.

Available at: http://works.bepress.com/robert_main/7/