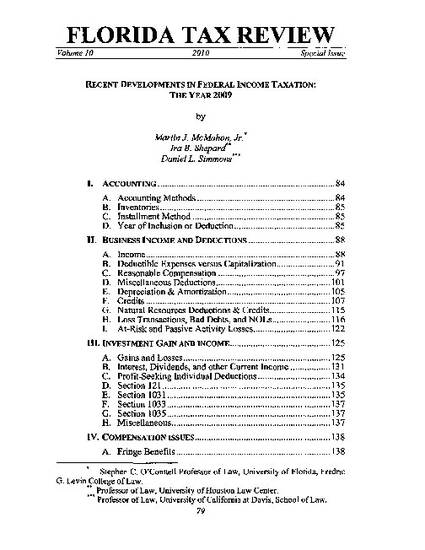

This article discusses, and provides context to understand the significance of, the most important judicial decisions and administrative rulings and regulations promulgated by the Internal Revenue Service and Treasury Department during 2008 – and sometimes a little farther back in time if the authors find the item particularly humorous or outrageous. Most Treasury Regulations, however, are so complex that they cannot be discussed in detail and, anyway, only a devout masochist would read them all the way through; just the basic topic and fundamental principles are highlighted. Amendments to the Internal Revenue Code generally are discussed to the extent that (1) they are of major significance, (2) they have led to administrative rulings and regulations, or (3) they have affected previously issued rulings and regulations otherwise covered by the outline. The outline focuses primarily on topics of broad general interest – income tax accounting rules, determination of gross income, allowable deductions, treatment of capital gains and losses, corporate and partnership taxation, exempt organizations, and procedure and penalties. It deals summarily with qualified pension and profit sharing plans, and generally does not deal with international taxation or specialized industries, such as banking, insurance, and financial services.