Article

Supply Contraction and Trading Protocol: An Examination of Recent Changes in the U.S. Treasury Market

Journal of Money, Credit and Banking

(2002)

Abstract

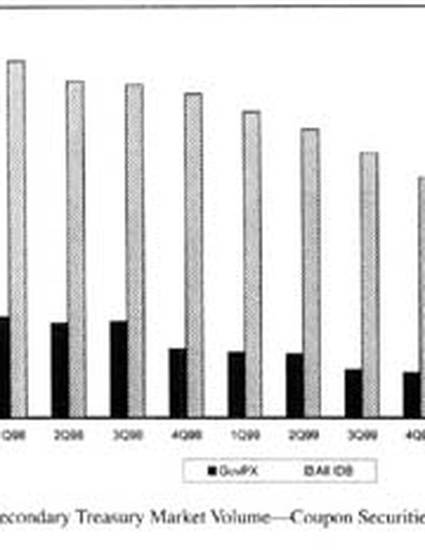

We investigate liquidity and trader behavior in the U.S. Treasury market during recent supply contractions. As in the precontraction period, dealers employ expandable order strategies to achieve greater-than-posted depth at the posted price and use expandable orders more often when expected information asymmetry is greater. Overall, however, dealers are less likely to discover greater-than-quoted depth during the supply contraction regimes. We find that, even after substantial losses in their market share of coupon Treasury trading, brokers reporting voice-brokered trading through GovPX provide an important protocol for depth discovery.

Disciplines

Publication Date

August, 2002

DOI

10.1353/MCB.2002.0010

Citation Information

"Supply Contraction and Trading Protocol: An Examination of Recent Changes in the U.S. Treasury Market" Journal of Money, Credit and Banking Vol. 34 Iss. 3 (2002) p. 740 - 762 Available at: http://works.bepress.com/leslie-boni/6/