Article

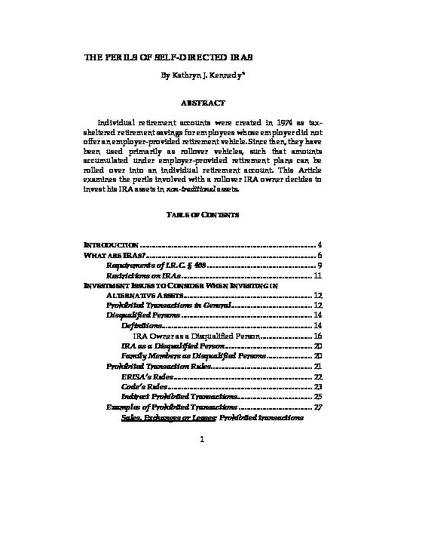

The Perils of Self-Directed IRAs

Marquette Benefits and Social Welfare Law Review

Publication Date

1-1-2020

Disciplines

Abstract

Individual retirement accounts were created in 1974 as tax-sheltered retirement savings for employees whose employer did not offer an employer-provided retirement vehicle. Since then, they have been used primarily as rollover vehicles, such that amounts accumulated under employer-provided retirement plans can be rolled over into an individual retirement account. This Article examines the perils involved with a rollover IRA owner decides to invest his IRA assets in non-traditional assets.

Citation Information

Kathryn Kennedy, The Perils of Self-Directed IRAs, 22(1) Marq. Ben & Soc. Welfare L. Rev. 1 (Fall 2020)