Article

The Robust "Maximum Daily Return Effect as Demand for Lottery" and "Idiosyncratic Volatility Puzzle"

Journal of Empirical Finance

Document Type

Article

Publication Date

6-1-2018

DOI

http://dx.doi.org/10.1016/j.jempfin.2018.03.001

Disciplines

Abstract

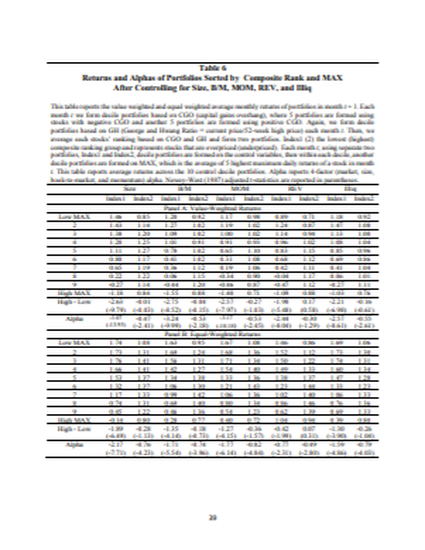

We form indexes of overpriced and underpriced stocks by ranking stocks based on the disposition effect and anchoring bias. We document the negative relation between maximum daily return and future returns (MAX effect) is confined to overpriced stocks which make up about half the entire sample. We find that the average cross-sectional correlation between maximum daily return and idiosyncratic volatility is nearly 90%. Consistent with prior studies the idiosyncratic volatility puzzle disappears after controlling for the MAX effect. However, when using a sample with a $5 price breakpoint and controlling for overpriced stocks the idiosyncratic volatility puzzle and the MAX effect are economically and statistically significant.

Creative Commons License

Creative Commons Attribution-NonCommercial-No Derivative Works 4.0 International

Citation Information

Egginton, Jared and Hur, Jungshik. (2018). "The Robust 'Maximum Daily Return Effect as Demand for Lottery' and 'Idiosyncratic Volatility Puzzle'". Journal of Empirical Finance, 47, 229-245. http://dx.doi.org/10.1016/j.jempfin.2018.03.001