Article

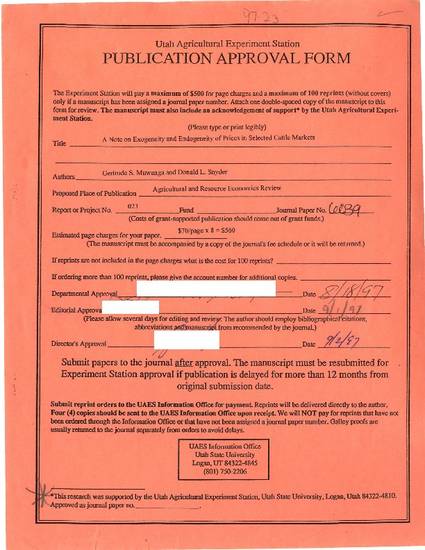

A Note on Exogeneity and Endogeneity of Prices in Selected Cattle Markets

Economics Research Institute Study Paper

Document Type

Article

Publisher

Utah State University Department of Economics

Publication Date

1-1-1997

Rights

Copyright for this work is held by the author. Transmission or reproduction of materials protected by copyright beyond that allowed by fair use requires the written permission of the copyright owners. Works not in the public domain cannot be commercially exploited without permission of the copyright owner. Responsibility for any use rests exclusively with the user. For more information contact the Institutional Repository Librarian at digitalcommons@usu.edu.

Abstract

Lead/lag relationships were identified for six cattle classes using Cattle-Fax data, for twelve markets. The relationships were either endogeneity/endogeneity (feedback), endogeneity/exogeneity (unidirectional), exogeneity/exogeneity (no causality) relationships. Feedback relationships were the most common, while only one case of no causality was identified. The long-run equilibrium was mainly driven by prices with a feedback relationship with all or most of the prices. Generally, markets with large cattle numbers led the others, and had more influence on the long-run equilibrium with a few exceptions.

Citation Information

Gertrude S. Muwanga and Donald L. Snyder. "A Note on Exogeneity and Endogeneity of Prices in Selected Cattle Markets" Economics Research Institute Study Paper Vol. 23 (1997) p. 1 - 22 Available at: http://works.bepress.com/donald_snyder/135/