Article

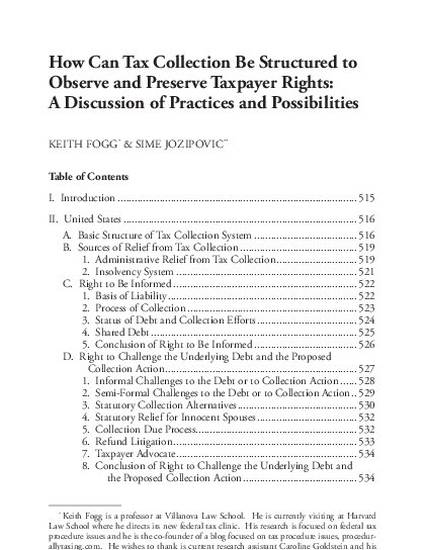

How Can Tax Collection Be Structured to Observe and Preserve Taxpayer Rights: A Discussion of Practices and Possibilities

Tax Lawyer

(2016)

Abstract

In the context of enforced tax collection, this Article will focus on three taxpayer rights the government should preserve in building an effective system: (1) the right to be informed, (2) the right to challenge the underlying liability and the proposed collection action, and (3) the right to a fair and just tax system. In order to provide a broad outlook on these principal taxpayer rights, this Article will discuss the tax collection systems of six countries: the United States, England, Germany, Switzerland, Croatia, and Australia. Within the context of each country’s enforcement mechanism, this Article will highlight how the identified taxpayer rights are viewed and determine the efficacy of each system structure in protecting the rights of its citizens. Finally, after outlining the collection process of each country, this Article will offer concrete observations on how to best protect the identified taxpayer rights when collecting from citizens who did not voluntarily pay, considering the rights and needs of individual citizens, as well as the needs of society as a whole.

Keywords

- tax collection,

- United states,

- England,

- Germany,

- Switzerland,

- Croatia,

- Australia,

- tax collection process,

- taxpayer rights

Disciplines

Publication Date

Spring 2016

Citation Information

T. Keith Fogg and Sime Jozipovic. "How Can Tax Collection Be Structured to Observe and Preserve Taxpayer Rights: A Discussion of Practices and Possibilities" Tax Lawyer Vol. 69 Iss. 3 (2016) p. 513 - 565 Available at: http://works.bepress.com/t_keith_fogg/38/