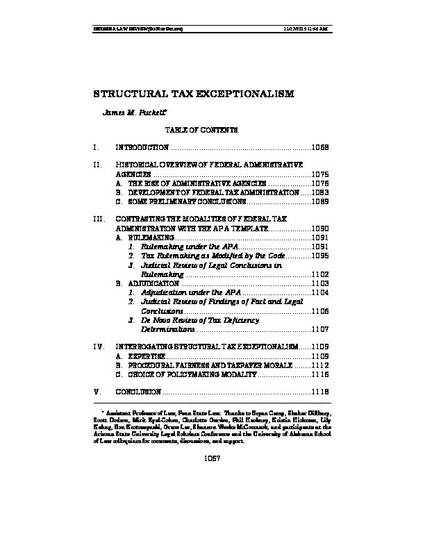

This Article argues that it is misleading to declare the death of tax exceptionalism and that structural tax exceptionalism may have important benefits. Part II provides a brief historical overview of the rise of federal agency administration of statutes and especially tax laws. The history trends to detract from anti-tax and anti-agency rhetoric that counsel disempowering the Treasury Department and other administrative agencies from comprehensively enforcing laws and making policy in their relevant domains. Part III analyzes how the Code's structure for tax administration differs from the APA template for administrative agencies. Part IV deconstructs these differences, drawing from general administrative law scholarship to identify potential advantages and drawbacks of structural tax exceptionalism. This Article concludes by recommending caution before dismantling the exceptional features of tax administration.

Available at: http://works.bepress.com/james-puckett/1/