Article

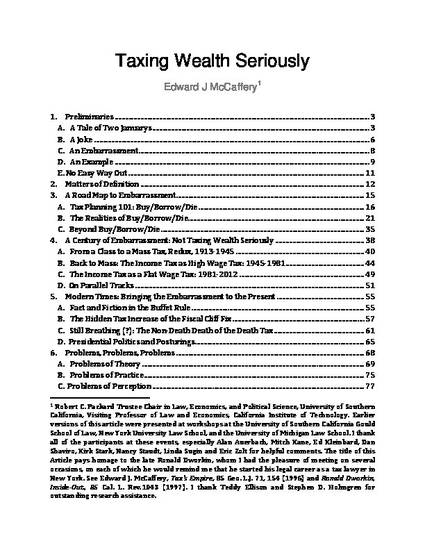

Taxing Wealth Seriously

The Tax Law Review (NYU)

(2017)

Abstract

The social and political problems of wealth inequality in America are severe and getting worse. A surprise is that the U.S. tax system, as is, is a significant cause of these problems, not a cure for them. The tax-law doctrines that allow those who already have financial wealth to live, luxuriously and tax-free, or to pass on their wealth tax-free to heirs, are simple. The applicable legal doctrines have been in place for nearly a century under the income tax, the primary social tool for addressing matters of economic inequality. The analytic pathways to reform are easy to see once the law is properly understood. Yet our political systems show no serious interest in taxing wealth seriously. We are letting capital off the hook, and ratcheting up taxes on labor, at precisely a time when deep-seated and long-running economic forces suggest that this is precisely the wrong thing to do. It is time -- past time -- for a change. This Article canvasses a century of tax policy in the United States to show that we have never been serious about taxing wealth seriously, and to lay out pathways towards reform.

Keywords

- wealth,

- tax,

- inequality,

- tax reform,

- economics,

- finance

Publication Date

Spring February 1, 2017

Citation Information

Edward J. McCaffery. "Taxing Wealth Seriously" The Tax Law Review (NYU) Vol. 70 Iss. 2 (2017) ISSN: 0040-0041 Available at: http://works.bepress.com/edward_mccaffery/24/