Article

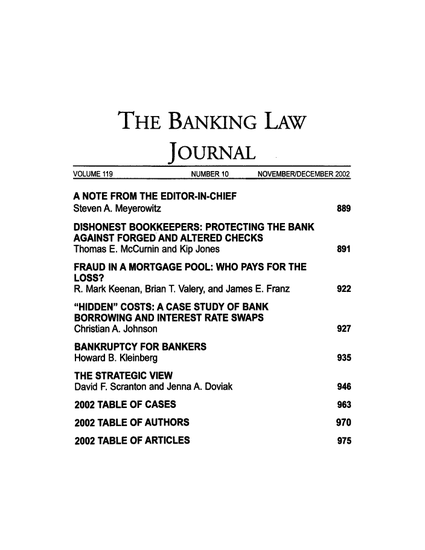

"Hidden" Costs: A Case Study of Bank and Borrowing and Interest Rate Swaps

Banking Law Journal

(2002)

Abstract

Large money center and regional banks actively target and market interest rate swaps to middle market borrowers. Because these customers borrow at a variable rate, their bankers encourage them to hedge interest rate risk by concurrently entering into interest rate swaps.

Disciplines

Publication Date

November, 2002

Citation Information

Christian A. Johnson. ""Hidden" Costs: A Case Study of Bank and Borrowing and Interest Rate Swaps" Banking Law Journal Vol. 119 Iss. 10 (2002) p. 927 Available at: http://works.bepress.com/christian_johnson/26/